Validators & Stakers

Pye is building bond markets for validators and delegators, enabling validators to offer better rates for long-term lock-ins.

We designed Pye to make staking deposits composable for delegators, unlocking DeFi opportunities for the 90%+ of staked SOL that currently sits idle and underutilized in validator nodes. With Pye, stakers can access a range of features, including:

- Lending protocols

- Restaking

- Yield forwarding

- Fixed-yield products

- Looping strategies

- Stablecoin (CDP issuance)

- Markets for validator votes

Motivation

Pye was built on two core insights:

- Validators are willing to share block rewards with delegators in exchange for longer-term deposits. Validators seek reliable, inelastic TVL, which in turn leads to predictable cash flows.

- Stakers are willing to lock into longer-term contracts if they get the best yield and can access DeFi (restaking, lending, yield splitting).

Market forces are pushing the market in this direction, with Lido V3 working on modular liquid staking and a more modular staking environment that benefits both stakers and validators.

These types of products are essential for onboarding TradFi and maturing the space, but they require a crypto-native twist to unlock more utility for a larger audience.

Solana’s APY is decreasing

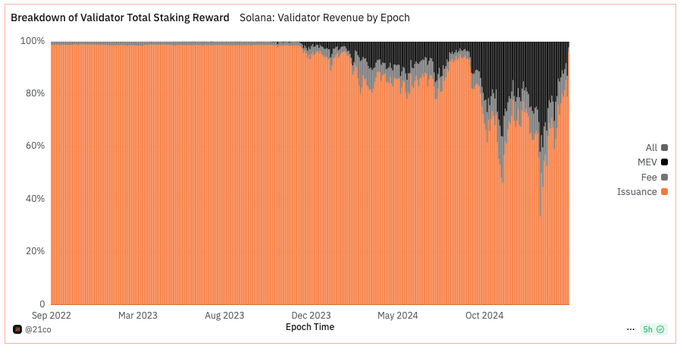

The inflation-adjusted staking APY on Solana is naturally decreasing as the network gains adoption, and with proposal such as SIMD-0228 may even drop to 3%. With rates coming down, validators are starting to compete for the same pool of stake.

Historically, delegators have received the standard staking reward rate on Solana, which is about ~7%. The remaining rewards — block rewards and MEV — have generally been kept by validators, and can reach up to 15%.

When you combine staking rewards, MEV, and block rewards, the APY is closer to ~17% in some cases.

Lack of Configuration Tools

Historically, stakers only received staking rewards, but now validators are starting to share both block rewards and MEV in exchange for longer-term stakes. These relationships have traditionally been captured at the SLA level through legal agreements, but there are no on-chain mechanisms to granularly track block rewards and MEV or configure how they are split between validators and delegators.

New initiatives, such as SIMD-0123, are being proposed to track these fees at the protocol level and provide operators with interfaces to configure reward splits.

SIMD-0123: https://github.com/laine-sa/solgov-distributor/blob/master/votes/simd0123/README.md

Commoditization of Validators

Each validator operator has a unique cost of production and is exposed to different risks.

Factors like validator uptime, geo-location, regulatory jurisdiction, infrastructure provider (e.g., AWS), fee structure, node client, and eventually slashing history contribute to each validator operator having a distinct risk profile.

As Solana’s staking ecosystem matures, we can expect validators to compete on new grounds beyond just pricing:

- Cost of production

- Risk profile

- Validator utility (e.g., restaking, looping, and loans)

Product

Bond Markets for Validators & LSTs

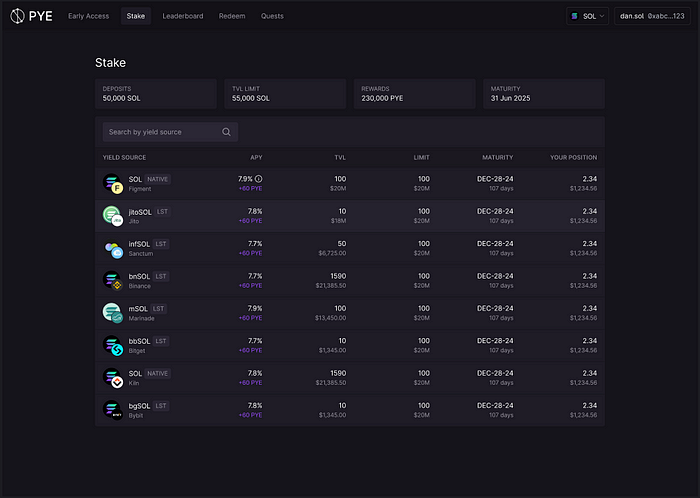

Pye is an on-chain, non-custodial bond marketplace for staked SOL. It’s a platform where validators can configure their reward split for different maturities (bond durations), and where stakers can transparently and securely delegate their stake to the best terms, with direct access to DeFi.

Pye is formalizing an existing behavior in the market by creating a market microstructure where delegators and validators can transact in an open, fair, and transparent way.

This dynamic between validators and delegators, where validators are willing to share more block rewards and tips in exchange for longer lockups, mirrors traditional bond markets, where T-bill yields increase with the duration of the bond.

Stakers

- Discover and stake in offers with the highest APY

- Access DeFi products (loans, restaking, stablecoins)

Validators

- Attract & retain TVL

- Incentivize long-term deposits

- Enables DeFi for their stakers

- Predictable cash flow

Tech Stack

- Trading Layer: Powered by manifest.trade, the majority of the user experience occurs on the Pye platform, where users can stake and trade variable-yield bonds.

- Issuance Layer: Custom implementation of Solana’s stake pool program. This allows users to stake via Pye or BYOS (bring your own stake); users can deposit existing stake from a validator or LST, where it is then locked into fixed-date terms, and bonds are issued to their wallet. Read more about the issuance layer below in the Primitive section.

Primitive

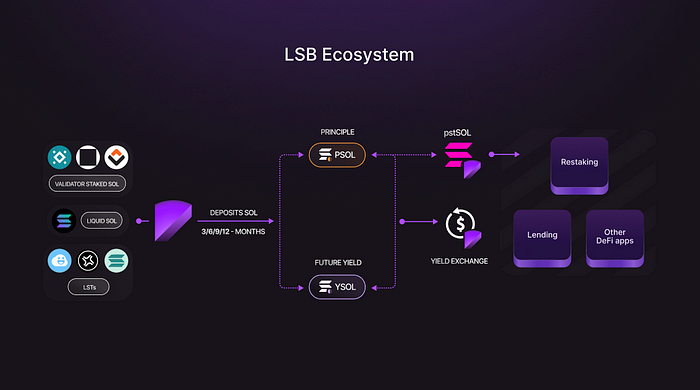

Liquid Staking Bonds (LSBs) sit on top of validators and LSTs and can be accessed via the Pye UI or the LSB smart contract.

LSBs are a novel primitive we designed to make staking capital more modular. We combine smart contracts and validator integrations to route staking deposits into two tokens:

- PSOL: The principal component of the stake.

- YSOL: The yield component of the stake.

At the time of deposit, we tag the individual stake with metadata related to the validator operator (reward split, fee structure, risk profile) and timelock the deposit into fixed-date terms. Much like a traditional bond, LSBs yield higher returns the longer you stake, as operators are willing to share more block rewards for longer duration stakes.

This unlocks an entirely new design space where stakes can be rated, structured, and traded in a risk-sensitive market that accounts for the inherent risks of each validator operator.

We’ll be releasing the official Liquid Staking Bonds white paper soon, which explains how we use smart contracts to split validator stake into PSOL and YSOL tokens, as well as the implications of this technology from a DeFi perspective and the products that can be built on top.

Next Steps

We’re gearing up for launch, Pye will initially support LST & validator deposits into bonds of 3 maturities in 2025: end of Q2, Q3 and Q4.

If you’re a validator and would like to become a launch partner, please fill out this form and reach out to our BD team: @eash0x on Telegram.

Meantime, follow us on our official links: X/Twitter | Discord | Telegram

Stay tuned and Happy Pi Day!